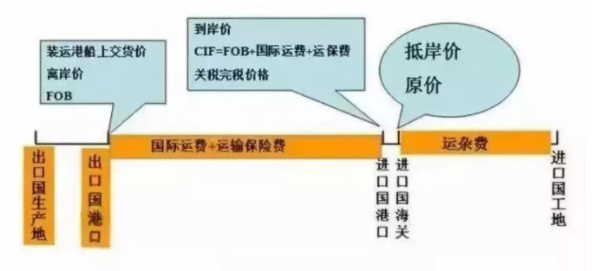

(FOB) FOB price,Also known as "free on board price", the English abbreviation is FOB, which is one of the commonly used trade terms in international trade. It refers to the sales price at which the transportation and insurance costs from the port of departure to the destination are borne by the buyer and not included in the settlement price.

For transactions conducted on an FOB basis, the buyer is responsible for dispatching a ship to pick up the goods, and the seller shall load the goods on the vessel designated by the buyer at the port of shipment specified in the contract and within the specified time limit, and notify the buyer in time. The risk is transferred from the seller to the buyer when the goods are loaded on board the named vessel at the port of shipment.

In this term, the risk we need to bear is to deliver the goods to the designated place of the customer's freight forwarder, but we must pay attention to this term-the point is the cost issue.

The cost components are: Domestic freight + local miscellaneous charges at the port, generally we tend to omit the local miscellaneous charges at the port.

Since the freight forwarder designated by the customer will charge a higher fee than our own freight forwarder, we must pay special attention when quoting the price to the customer, or this will be the point where our profit will decrease.

When we quote FOB prices to customers, the price we quote to customers consists of: domestic freight + local port miscellaneous charges + cost price of goods. We must not record FOB as EXW to calculate the cost, otherwise part of the cost will be lost, and maybe that part of the cost is just our own profit.

Then we know that there is an FOB price, so there must be a CIF price. For a long time, people have been accustomed to calling the FOB price condition in international trade as the FOB price, so that the price term includes freight and insurance. CIF is said to be CIF.

But the real CIF price is not CIF, but DES. DES refers to the delivery on board at the port of destination. The seller must be responsible for transporting the goods to the ship at the port of destination, and is responsible for all costs and risks before the goods arrive at the port. The goods are handed over to the buyer on board, but the seller will complete the delivery without going through the import customs clearance procedures. .

CIF is not CIF because the risk transfer limit of CIF is also the side of the ship rather than the port of destination. Because the CIF term belongs to formal delivery, that is, after delivery on the ship's side at the port of shipment, the risk is transferred to the consignee, and the delivery does not need to be delivered to the customer's designated port to complete the delivery.

For example, in a contract concluded using the CIF price term, if the cargo-carrying ship runs aground and sinks before leaving the port of shipment, the buyer cannot submit a claim to the seller, because the risk after passing the ship's rail has been transferred to the buyer, and the buyer can only rely on The insurance contract makes a claim to the insurance company, which shows that the seller is not responsible for the risk to the port of destination. So let's not mistake CIF for CIF.

Regarding the FOB price, we should pay special attention to the miscellaneous charges at the port of departure. Since we will not know the information of the customer's designated freight forwarder until we have discussed all the costs with the customer, then we will miss the time to know the customer's designated freight forwarder to charge. Standard, then for us the difference between the cost and our budget will cause us a certain loss.

Therefore, after we have negotiated the trade terms with the customer, we have to ask the customer to specify the freight forwarding information to check with them how much the local port miscellaneous charges for this batch of shipments are, so as to achieve the most accurate quotation, and do not let the profit of our budget be overwhelmed. So gone.

How does delivery without a bill of lading come about?

FOB means that the buyer specifies the carrier (usually a foreign freight forwarder and its agent in China), and the buyer controls the transportation; the freight forwarder often obeys the buyer, or is even directly controlled by the buyer; this situation usually occurs when the goods are delivered without a bill of lading Down!

This type of trade usually produces two sets of bills of lading: the shipowner's bill and the freight forwarding bill. The freight forwarder uses itself (or its agent) as the shipper to book space with the shipping company and obtain the ship owner's bill; what the domestic exporter gets is the bill of lading issued by the freight forwarder (or even the bill of lading), and the consignor and consignee usually show the are sellers and buyers.

After the freight forwarder obtains the ship owner's bill from the shipping company, it can directly send it to the foreign agent, and the foreign freight forwarder can pick up the goods from the shipping company after receiving the ship owner's bill. As for whether the foreign freight forwarder needs to take back the freight bill when it delivers the goods to the actual consignee, this is another matter. Once the foreign freight forwarder does not require the consignee to return the original bill of lading when delivering the goods to the consignee, the bill of lading in the hands of the consignor can be regarded as waste paper in a sense.

Which delivery method is safer?

Facts have proved that in the export business, as the seller, according to the specific circumstances of the transaction, it is very necessary to carefully select the appropriate trade terms to prevent the risk of foreign exchange collection and improve economic benefits. Let's talk about several issues that should be paid attention to when choosing trade terms.

Generally speaking, it is more beneficial to use CIF or CFR terms in export business than to use FOB. Because, under CIF conditions, the seller is the party to the three contracts (sales contract, transportation contract and insurance contract) involved in the international sale of goods, and he can make overall arrangements for stock preparation, shipment, insurance and other matters according to the situation to ensure the operation process. interconnection on top. In addition, it is conducive to the development of the country's shipping industry and insurance industry, increasing the income from trade in services. Of course, this is not absolute. You should first consider whether it is difficult to arrange transportation yourself according to the specific conditions of the traded commodities, and whether it is economically cost-effective and other factors.

The risk of FOB is also that if the designated freight forwarder cannot directly book the space, but books the space through other professional airline freight forwarders, then there is no real control over the property rights in the transportation, resulting in that if there is a problem in transportation, it cannot be solved in time.

The seller may say that we are not responsible for the transportation of this FOB shipment, and it has nothing to do with us. I don't need to worry about it. It is precisely this point of view that has some problems, because when the cargo transportation route is a multiple-choice question, when the transportation time is prolonged, what increases is the increase in the capital circulation cycle of the manufacturer. For example, if you go to South America, some ships will take about 60 days, and some ships will only take half the time (I won’t talk about the specific shipping company, remember to ask the voyage when the manufacturer books the space, this is very important), this will delay the transfer to The time the customer received the payment. In order to reduce the transportation cost, the consignee sometimes chooses to ship with a longer voyage. Such behavior is understandable. Of course, some manufacturers are willing to ship with a longer voyage because of warehousing, which can reduce storage costs. If the value of the goods is small, then nothing can be seen. If the value of the goods is large, the customer’s slow payment will lead to the uncertainty of the exchange rate. I think the manufacturers have a deep understanding. The current exchange rate changes every day. We must pay attention to the problem of loss.

If it is necessary to use FOB conditions to complete the transaction

Precautions

1. The time for the buyer to send the ship to the port for loading should be clearly stipulated in the contract, so as to avoid the delay in the arrival of the ship after the seller has prepared the goods, which will delay the loading date.

2. Increase the deposit ratio to reduce the probability of customer rebellion. When the shipping method can't beat the customer, you must keep the bottom line in the payment method, and you would rather earn less or not do business, and you can't take the risk of losing money.

3. In the trade contract, the buyer and the seller agree on the freight forwarding company, which is not necessarily limited to a certain one. If the carrier and the bill of lading have not been filed with the Ministry of Communications of China, then you have to be careful. (The recorded bill of lading and the carrier need to pay a deposit, which makes the bill of lading relatively safe.) If the buyer insists on being paranoid about his own opinion, the seller must consider the risk. Accept well-known shipping companies and insist on using the shipping company's bill of lading, and try to avoid using the designated overseas freight forwarder and the bill of lading issued by it. At the same time, the owner of the goods should ask the freight forwarder in my country to issue a letter of guarantee when handling the formalities of the port of shipment on behalf of the overseas freight forwarder, promising that the goods arranged by the designated overseas freight forwarder must be delivered with the original bill of lading circulated by the bank under the letter of credit after arriving at the port of destination, otherwise they will be charged Liability for compensation for delivery of goods without a bill of lading, only in this way, once the goods are delivered without a bill of lading, can there be a basis for claiming.

4. In the case of FOB export, it must be clearly stated in the contract that the consignor entrusts the freight forwarder or NVOCC to book space with the shipping company, and the right to book space cannot be handed over to the buyer, because of the obligation of space booking and delivery is uniform. The shipper (shipper) column in the bill of lading must fill in the name of the consignor (seller). The consignor has the right to entrust the booking space, and also has the right to control the goods. If the buyer's credit is good and there is a requirement to resell the goods in transit, it is also acceptable to use the buyer as the shipper. If you don't know the credit of the buyer, it is better to use the seller as the shipper for the sake of safety.

5. It is also advisable to use the instruction bill of lading issued by the consignee, so that the bank can tightly control the rights of the goods and prevent the risk of releasing the goods without a bill of lading.

6. Invest in China Credit Insurance Corporation to hedge risks. Before investing, learn about the countries and regions they are not insured for and blacklist customers, and learn more about the cases of being rejected by CITIC Insurance to avoid worsening the situation.

—What should the seller do in the event of delivery without a bill of lading?

Suggestions given on the Internet include finding an embassy, calling an international language department, adding various blacklists, and finding a collection company, not to mention whether the client is a professional fraud, whether there are several companies in the Three Caves of the Rabbit, whether there is a gangster background, yes Whether you care about these threats or not, just going overseas to follow up with Zhang Luo will inevitably waste people, money, and exhaustion, and you don't need to do the next business.

Property rights are the most important thing in foreign trade. Don't bury your head in bargaining all day and fall into the trap set by others. Again, it is better to prevent problems before they happen than to remedy after the event.